When applying for credit products like credit cards, loans, or mortgages in Hong Kong, lenders typically request to review your credit report. Your TransUnion (TU) credit report is crucial in determining the loan application result and interest rates, which can significantly impact your personal finance. How much do you know about your TU credit report and score? Read on to discover some common questions about TU credit report and how it works.

What is a TransUnion Credit Report?

In Hong Kong, as long as you have applied for a credit card or personal loan, you will have a credit report. TransUnion is the only institution that provides personal credit reports in Hong Kong. Your credit card application, loan application, repayment, and overdue records are all recorded in TransUnion’s database, which makes up your credit report.

Your TU credit report contains the following information:

- Personal information: Name, ID number, address, and phone number

- Credit account information: Credit usage and overdue repayment records

- Public records: Debt collection, bankruptcy, and liquidation lawsuits

- Inquiry records: The inquiry records of TransUnion members (banks and financial institutions) in the past two years.

- Credit score: A summary of your credit rating, with a total of 10 levels, with A being the highest and J being the lowest.

Your credit score is a vital aspect of your credit report. When borrowing money, those with an A-grade credit score have a greater chance of obtaining the bank’s best interest rate, with an actual annual percentage rate (APR) of less than 5%. In contrast, for J-grade credit scores, the interest rate can be as high as 45% or more, resulting in significant differences in interest expenses.

| Grades | Credit Level | Credit Score |

| A | Excellent | 3526 – 4000 |

| B | Good | 3417 – 3525 |

| C | Good | 3240 – 3416 |

| D | Averaged | 3214 – 3239 |

| E | Averaged | 3143 – 3213 |

| F | Averaged | 3088 – 3142 |

| G | Poor | 2990 – 3087 |

| H | Poor | 2868 – 2989 |

| I | Poor/Near Bankrupt | 1820 – 2867 |

| J | Poor/Near Bankrupt | 1000 – 1819 |

Factors that Affect Credit Scores

Various factors affect your credit score, including:

- Repayment history

- Credit inquiry records

- The ratio of credit usage

- Length of credit history

- Type of credit account

Among these factors, repayment history has the most significant impact on your credit score. If you have ever defaulted on a credit card or missed a repayment, it will be recorded in your credit report. Even if you were just one day late in repayment, this record would be kept for 5 years. Therefore, paying attention to the repayment date and repay on time is essential.

When Will Credit Reports Be Checked?

When applying for a mortgage or personal loan, banks or financial institutions will request borrowers to sign a data-sharing consent form and obtain the applicant’s credit report from the credit rating agency to determine whether the applicant is a reliable borrower. This process can affect the final result and amount of the loan granted.

If there are multiple hard inquiries in a short period, it will cause the credit score to decrease. Therefore, it is best to avoid applying for loans from too many institutions simultaneously.

In some cases, if the bank or financial institution believes that they have sufficient information on the credit usage status of their existing customers, they may approve credit products without checking the credit report.

How to Improve Your Credit Score?

Maintaining a good credit score is essential to accessing credit for big-ticket items such as homes, cars, and other personal loans. Many may wonder if using only cash and not applying for credit cards or loans will give you a high score. In fact, this will result in a blank credit history and will not help your score. To improve your credit score, you should:

- Make timely payments every month and pay off all bills

- Regularly check your credit report and promptly correct any problematic information

- Avoid applying for too many loans to maintain a good credit history

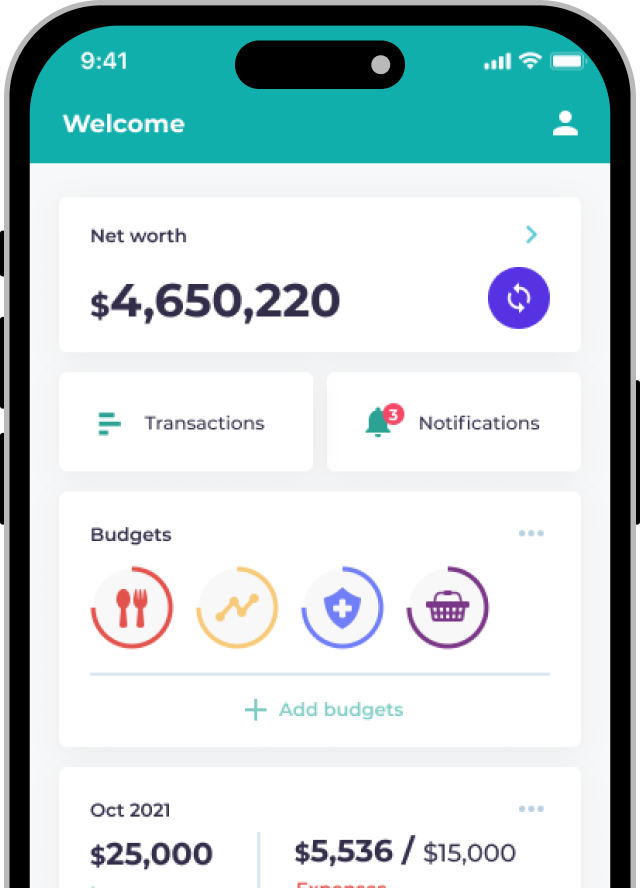

How to Check Your TU Credit Score?

TransUnion allows you to access your credit report directly in two ways:

Option 1: Directly Obtain Your TU Credit Report

You can directly obtain your TU credit report by making an appointment online and bringing your identification documents and a valid address proof issued within the last three months to the TransUnion office at Suite 811, 8th Floor, Tower 5, The Gateway, 15 Canton Road, Tsim Sha Tsui, Kowloon, Hong Kong. The cost is HK$280; payment can be made by VISA/Mastercard or cash.

Option 2: Check Your TU Credit Report for Free

Suppose a bank or financial institution has rejected your credit application (including credit cards, loans, and mortgages), and they have previously obtained your credit report from TransUnion. In that case, you will receive a rejection letter. You can then follow the instructions in the letter to get a free credit report from TransUnion.

Find the Best Personal Loan Offers in Hong Kong

FAQs about TU Credit Report

The cost to obtain a TU Credit Report is HK$280, and you can do this in person at the TransUnion office or online.

If you have been rejected for a credit card, loan, or mortgage by a bank or financial institution, and they have previously obtained your credit report from TransUnion, then you can apply for a free credit report from TransUnion with the rejection letter.

Recommended Readings

To borrow or not to borrow? Borrow only if you can repay!