The demand for small loans in Hong Kong remains substantial. What are your options if you need to borrow a modest amount, such as HK$50,000, HK$100,000, or HK$200,000, for cash flow purposes?

Many banks and lending companies in the market offer small personal loan products that are easy to apply for and have swift approval processes. Some small loans, such as those from CreFit and Grantit, are TU-free (do not require a TransUnion credit check), allowing you to use your funds flexibly. Some lenders even permit borrowing as low as HK$10,000 or less.

Below, we share the unique advantages and critical considerations of small personal loans to help you find a loan solution that suits your needs.

Comparison of Money Lender Loan 2025 – Find Out the Best Interest Rates and Offers

Characteristics of Small Personal Loans

The current market has no clear-cut boundary between small and large loans. Generally, borrowing HK$100,000 or less is considered a small loan, while amounts like HK$150,000, HK$200,000, HK$250,000, and HK$300,000 may be classified as small or medium loans, depending on the lending institution.

Variable Interest Rates for Small Loans

The Annual Percentage Rate (APR) for small loans is typically higher than that for large personal loans. However, many financial institutions offer competitive loan rates, so borrowing a smaller amount doesn’t necessarily mean paying higher interest. The key is to compare different offers to find the best deal.

Using an APR of 5% and a repayment period of 36 months, the monthly repayments and total interest for small to medium loans are as follows:

| Loan Amount | Monthly Repayment (HK$) | Total Interest Paid (HK$) |

| HK$10,000 | 313.36 | 1,281.09 |

| HK$20,000 | 626.73 | 2,562.18 |

| HK$30,000 | 940.09 | 3,843.27 |

| HK$40,000 | 1,253.45 | 5,124.37 |

| HK$50,000 | 1,566.82 | 6,405.46 |

| HK$60,000 | 1,880.18 | 7,686.55 |

| HK$70,000 | 2,193.55 | 8,967.64 |

| HK$80,000 | 2,506.91 | 10,248.73 |

| HK$90,000 | 2,820.27 | 11,529.82 |

| HK$100,000 | 3,133.64 | 12,810.92 |

| HK$150,000 | 4,700.45 | 19,216.37 |

| HK$200,000 | 6,267.27 | 25,621.83 |

| HK$250,000 | 7,834.09 | 32,027.29 |

| HK$300,000 | 9,400.91 | 38,432.75 |

This table demonstrates the monthly repayment amounts and total interest paid over 36 months for various small to medium loan amounts at a 5% APR. Borrowers can use this information to evaluate their financial capacity and select the loan amount that best fits their requirements.

Fast Approval Times for Small Loans

When applying for large personal loans, lending institutions typically require identification documents, proof of address, and income verification to manage risk. This results in longer approval times, which may not be ideal for those needing urgent funds.

In contrast, institutions specializing in small loans often offer online loan services without requiring income proof or even a TransUnion credit check. Applications can be approved within minutes, and funds can be disbursed in under an hour. For example, Grantit’s TU-free personal loans are approved and disbursed within an average of 28 minutes, while CreFIT and X Wallet offer instant approval for small loans.

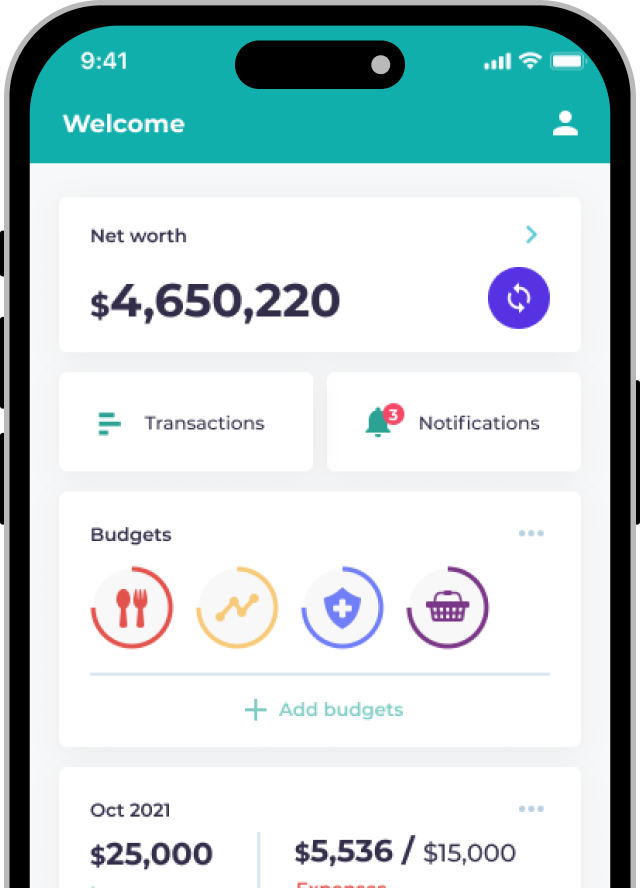

24-Hour Application Availability

Many virtual banks and money lenders have robust online lending platforms, allowing users to submit loan applications anytime, 24/7, through websites or mobile apps. This convenience is especially beneficial when borrowing smaller amounts like HK$50,000 or HK$100,000, as the application process is more streamlined.

Additionally, numerous money lenders provide fully automated and round-the-clock small loan approval services, enabling users to complete their loan applications quickly. For instance, CreFIT and Grantit offer entirely online loan approvals that can be completed in just a few steps.

Diverse Loan Products

Large amount loan products are typically more rigid due to the substantial amounts involved, as they aim for stability in their product models. In contrast, banks and lending companies offering small personal loans are usually more flexible and introduce various loan products. This flexibility allows them to cater to customer needs and attract more clients.

Key Considerations for Small Personal Loans

Higher Interest Rates

While large personal loans can offer low interest rates, as low as 2% or below, small personal loans often have higher APRs due to simplified borrowing procedures and fewer documentation requirements. Therefore, it is crucial to assess your repayment ability before taking out a small loan.

Early Repayment May Not Be Beneficial

Some borrowers of small loans may choose to repay early when their finances become more flexible. However, early repayment does not always lead to interest savings because lenders typically use the “78 method” to calculate interest, where the interest proportion decreases as the repayment period progresses.

Moreover, early repayment usually incurs processing fees, which might outweigh the interest savings. It is advisable to consult with the lending institution before deciding to repay early.

Pay Attention to Terms and Conditions

Although small personal loans are convenient and have more lenient requirements, it is essential to carefully review the loan plan’s details, including the loan amount, repayment period, terms and conditions, and any requirements for obtaining benefits (such as being a new customer).

Some low or zero-interest loan products may require you to meet specific conditions or repay within a certain timeframe. If you miss these conditions, the interest rates can become significantly higher. Therefore, thorough research and understanding of the loan terms are necessary to avoid being misled by temporary offers.

To borrow or not to borrow? Borrow only if you can repay!

Warning: You have to repay your loans. Don’t pay any intermediaries.