Have you ever felt that your salary is never enough, housing is too unaffordable, that it’s so difficult to achieve financial progress and so on?

No matter whether you’re a realist or an idealist, living in Hong Kong, where the Gini coefficient is among the highest in the world, we might all have some trouble with money. Learning proper wealth management can help us solve some of these troubles and get on the road to financial freedom.

Understand Net Assets

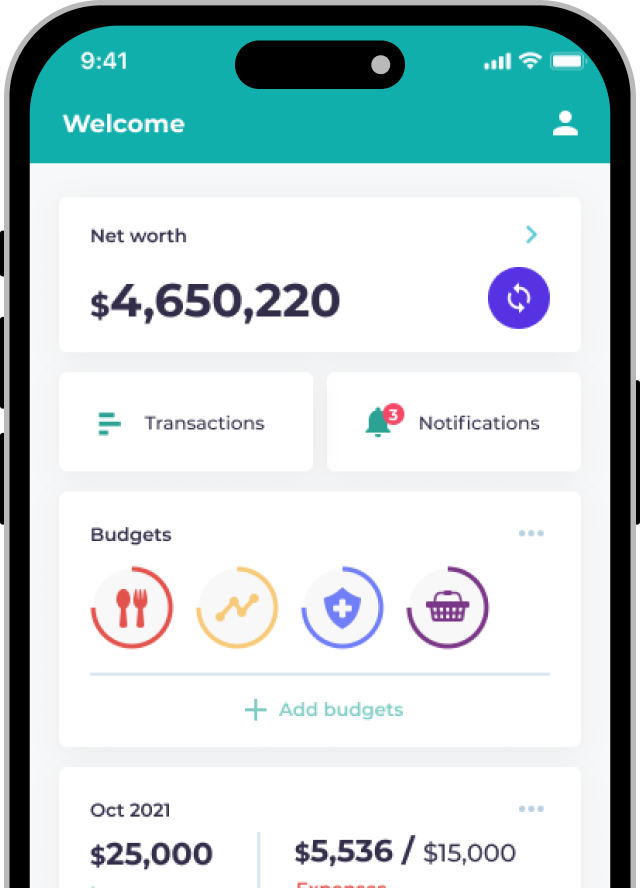

Wealth Management is the management of assets – so to understand wealth management, you have to establish a basic concept of ‘net assets’.

Net assets are defined as the sum of current assets (cash and bank deposit), non-current assets (properties and automobiles) and investments (stocks, bonds and MPF) minus liabilities (mortgages, loans and credit card balance).

There are many kinds of personal assets, and the value of assets can rise or fall every day. It is not easy to master the value of your assets. Planto can help you stay on top of your net assets – once you link your accounts, you can get a clear snapshot of your assets’ value.

How inflation can erode your wealth

When managing your wealth, the impact of inflation must be considered. In recent years, Hong Kong’s inflation rate has been about 2.5%. If a person has a monthly saving of $5,000, he will have $1,800,000 in 30 years, but by that time the $1,800,000 will be equal to only about $1,250,000 now! Inflation cost him 30% of his assets.

No matter how frugal you are, assets of cash or bank deposits will still be eroded by inflation. The only way to fight inflation is to grow your assets with investment.

Master cash flow through expense tracking and budgeting

Cash flow is one of the key concepts in personal finance. It refers to the inflows and outflows of funds, which means our income and expenses. The goal is to increase capital inflows and reduce outflows.

Saving money is not about being abstinence. As you understand your consumption habits, you can effectively eliminate the unnecessary expenditures to increase your savings without affecting your quality of life. Unnecessary expenditures might include taxi fares due to getting up late or the subscription fee of streaming services that you don’t use!

Many Hong Kong people have more than one credit card and bank account, which makes recording expenses more difficult. Planto’s automatic expense tracking will help track your monthly income and expenses by categories so that your cash flow is clear at a glance! It also helps you distinguish between the “wants” and “needs” of your daily expenses to make a better monthly financial plan and help you figure out what works for you!

Credit Cards: Earn cash-backs to cut expenses

There are so many credit cards on the market, and each has its unique benefits, including cash rebates, Asia Miles rewards, automatic add value service (AAVS) of Octopus Cards, free entry to airport VIP lounges and so on. Choose the best credit cards according to your consumption habits to help reduce daily expenses.

While credit card rebates are tempting, you must retain yourself from fall into the trap of overspending. According to neuropsychologists, brain areas associated with pleasure and pain light up in brain image scanning when people purchase with cash. But when they pay with credit cards, only the pleasure area light up.

So, to many people, credit cards indeed don’t feel like money. But you can still retain your mind and spending behaviour through some brain training practices. For instance, paying with cash could give your brain a pause and rethink the buying decision. You can also automate your savings simply by setting up an automatic deposit for your savings and investment accounts, encouraging you to develop a disciplined saving habit.

Start Investing: With securities firms at a lower cost

To start investing, you have to open a securities account. Many banks and securities firms provide Hong Kong stock accounts and US stock accounts with varied fees – so how do you choose?

Assuming investors put HKD 20,000 each month to invest in stocks and trade on average five times a month. The mainstream banks would cost you around $525 each month. If you use the securities firms mentioned above, the monthly transaction fee is only about $100 per month.

This difference of 425 HKD each month adds up fast. In 10 years, it becomes HKD 51,000 in expenses (HKD 425 x 12 months x 10 years)!

If you were to invest this difference with an annual return of 6%, you’d be missing out on almost HKD 70,000 (assuming a 6% annual investment return).

Given that these securities firms are licensed by the SFC and you get investor protection, you may want to think twice before choosing a bank for investing.

Start Investing: Understand the risks of products

Investing helps to add value to our assets, fight against inflation, increase cash flow and improve quality of life. Amateur investors might be worried about losing money. But as mentioned above, without investing, cash is bound to be eroded by inflation. Therefore, we should not resist investing because of fear. Instead, we try our best to increase the return on investment and taking risk you’re comfortable with.

Common investment and saving products include stocks, currency funds, time deposits, bonds and annuities. Recently, there have also been robo-advisors that help invest by select stocks and funds, and ultimately do the investing for you. Don’t forget that MPF is also an investment tool, which includes stocks, funds and bonds with different risks – instead of leaving your MPF unchecked, manage it properly like another investment account!

You must first understand the characteristics and risks of products before investing them. In general, the higher the risk, the higher the return, and vice versa. For example, Futu Securities’ monetary fund is a low-risk product with only about 2% return rate. The stock market has high volatility, but the return is also high. Buying ETFs is equivalent to buying multiple stocks at the same time, which has a diversified investment effect.

How to develop your investment strategy

Making money is a game of numbers, and our ultimate goal is to achieve our life goals through investing and increasing net assets. Therefore, you must develop an investment strategy based on your personal goals.

For example, if you are planning to buy a home and get married in 1 year, you should take stability as the priority, so that you don’t put your grand plan of starting a family at risk. If you are a fresh graduate and planning to buy a property in 10 years, you could consider being a bit more aggressive. If your investment objective is to increase your cash flow every month, you may consider more stable dividend stocks or bonds.

Manage your MPF well

For every Hong Kong employee, a monthly salary of 5% is required for MPF contributions, and employers are also required to contribute another 5% for the employee. Take a 25-year-old employee with a monthly income of $20,000 as an example. Calculated with a salary increase, 10% of monthly contribution and an annual return rate of 4.8%, at the age of 65, the MPF can bring him more than $5,000,000 of wealth. If you ignore the management of MPF, you will miss out the opportunity for assets accumulation.

There are mainly 5 types of MPF, ranging from the highest risk to the lowest risk, are equity funds, mixed-assets funds, bond funds, guaranteed funds and conservative funds, and can be invested in different countries, regions and types of asset. Employees should make diversified investment based on their life stages and retirement targets. If you choose Target Date Fund (TDF) or Default Investment Strategy (DIS), the risk of investment portfolio would decrease as you age. If you wish to increase your MPF contributions, you may consider using Tax Deductible Voluntary Contribution (TVC), to earn a tax deduction of an annual cap of $60,000.

After each transfer of jobs, if the employee does not give any instruction to the MPF account, the original contribution account will automatically become a “Personal Account” to continue investing. An employee can choose between having more than one MPF account to make diversified investments or consolidate the MPF personal accounts to make more convenient management.

Buying Insurance: Set a financial safety net for you and your family

Young workers might be confused about life insurance or even think it is unnecessary. From the perspective of personal finance and risk management, insurance can be regarded as a line of defense. Once the insured person encounters a disease, accident or even death, he will not lose all financial support immediately.

To avoid savings and life plans being affected by accidents, we should consider buying medical, critical illness, accident, home, travel or other insurance under the circumstance of economic stability. Besides, the Hong Kong government provide tax incentives for the Voluntary Medical Insurance (VHIS) program users. Buying insurance for yourself and your family could save taxes.

Important information: Investment involves risks. This information is intended to be educational and is not tailored to the investment needs of any specific investor. This information does not constitute investment advice and should not be used as the basis for any investment decision nor should it be treated as a recommendation for any investment or action. Past performance is no guarantee of future results. The value of investments and the income from them can go down as well as up, so you may not get back what you invest.