Investing with your own money for the first time is nerve-wrecking — what if the market goes down? When do you stay on-course and when do you cut your losses? What if you end up losing money?

News flash: these fears are normal. Even the most seasoned investors were once just as anxious as you are now.

The five principles below will get you started on the trade:

1. Define your goals (short, medium or long)

Investment should not be an aimless game for bigger numbers but a tool to get what you want in life. Know your objectives well, so you can plan your investment strategy accordingly. How much you invest and the risk you are willing to take should fit your goals, not the other way round.

This is called your "time-horizon" and it's probably one of the most important factors when deciding what to invest in.

First, an example of a short term goal: a travel trip or a new phone within a year. The riskier way to go about is short-term or day trading in the stock market; the safer way is a fixed term deposit with a high interest rate or a money market fund.

The mid and long term goals are the life-changing ones — your first home’s down payment, emigration plan, children’s college fund, etc. These require — and deserve — more time and thoughts in planning. Putting your life goals on hold is no good so make sure you're building a diversified portfolio and investing regularly to mitigate your own risk.

One more thing: review often how achievable your goal is. Chasing unrealistic riches like a conquistador looking for El Dorado will get you nowhere.

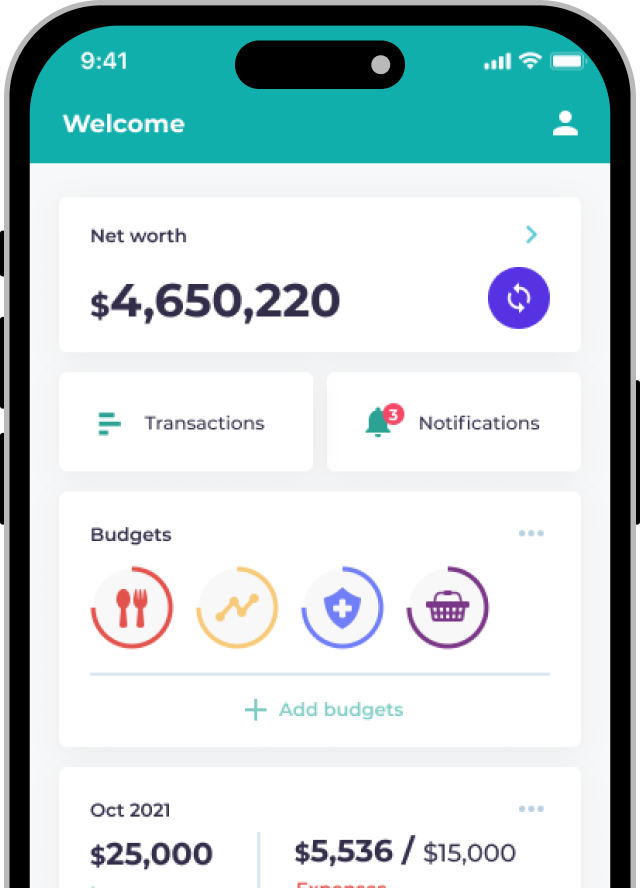

2. Watch your daily balance

You end up with what you have not spent. The less expensive your lifestyle is, the more you have to add to your investment fund every month.

Today onwards, try to record your daily expenses to understand your spending behaviour. You may find that the daily $30 coffee for the past year could have been one lot of China Construction Bank (00939) shares in your portfolio. Of course, living a life you don't enjoy wouldn't be healthy or sustainable either, so don’t go overboard with cutting costs and pruning your lifestyle.

3. Always be learning

Many beginners hesitate in fear of failure, missing chances upon chances; others enter the market without a proper strategy or mentality and overreact to irrelevant market fluctuations. Investing is not rocket science, but it’s not child’s play either. Start reading financial news and books, and get familiar with common jargons like “blue chip stocks”, “utility stocks”, “index fund”, “price-to-earning ratio”, etc. Analyses and commentaries are also a great resource to gain a deeper understanding on the movements of markets and individual stocks.

With knowledge comes the ability to identify right investment decisions and the confidence to make them.

4. Keep calm

Unless you are an AI investment bot, be prepared for moments of impulse, waver and doubt.. especially when the market appears to be going down!

Your rationality must prevail. A part of you will want unrealistic gains but it's important to be realistic and think about your goals first. As long as you have a diversified portfolio and are taking your goal's time horizon into account, you'll be fine!

5. Prepare for rainy days

Not everything goes according to plan. Unanticipated unemployment and medical expenses will cost you. Without an emergency fund, you may need to prematurely cash out on the investment you have made, taking a toll on your lifestyle and the grander plan for the future. It is highly recommended to reserve at least six months’ worth of living expenses in cash, and top it off with accident, medical and other insurances as you see fit. Remember to always keep a card up your sleeve as you can't be sure what the future holds.

Ready to start investing?

Next steps