Open API (Application Programming Interface) has been one of the hottest fintech topics since HKMA announced the Open API framework for Hong Kong banking sector. As part of their Smart Banking initiative, the purpose is to provide a secure, controlled and convenient operating environment to allow banks to integrate with third party service providers and offer better banking experiences for consumers.

Despite the hype, many still wonder what Open API is and how it works. Here is what you need to know about the new framework and why it is relevant to you.

Open API for the Banking Sector – How it works?

Open API in the banking sector allows third parties to have access to the systems of financial institutions and retrieve data under the supervision of the HKMA. Third parties, such as fintech companies, can access and consolidate the data to provide innovative services and products for consumers.

What benefits can API bring for YOU?

Convenience & Transparency

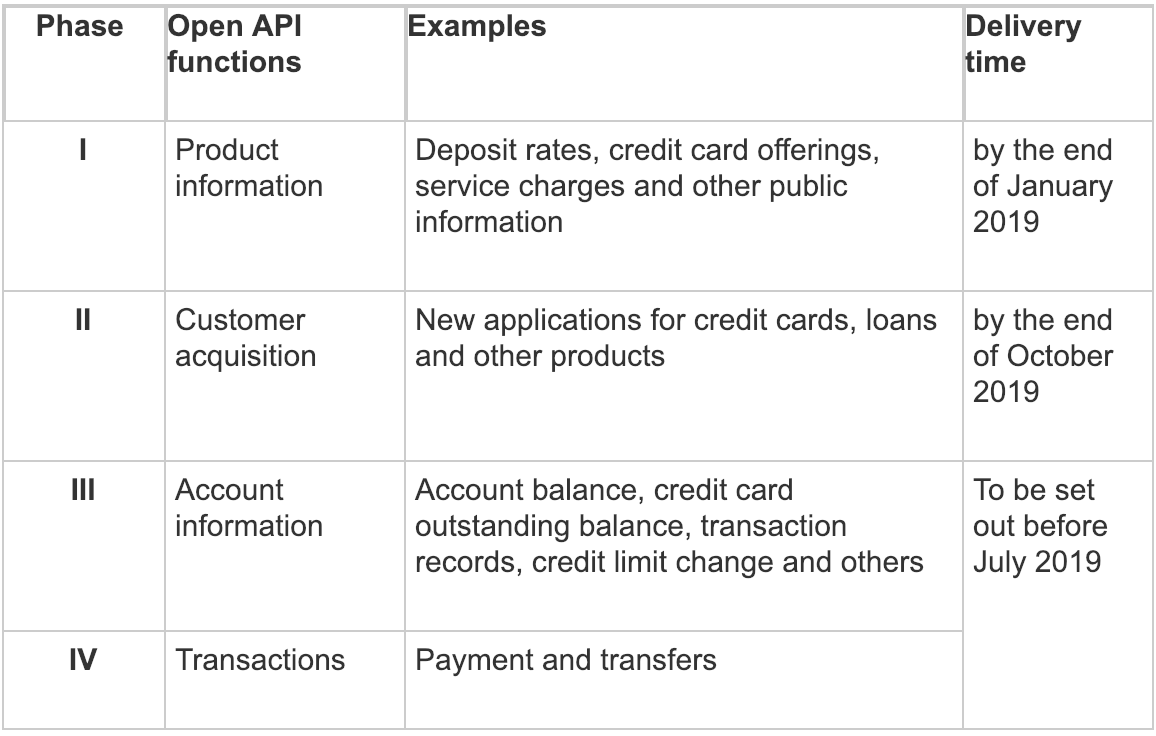

Two of the four Open API functions (as seen below) will be to open up product and account information to third parties by financial institutions. With product offerings and bank accounts aggregated in one place by third party comparison platforms and aggregators like Planto, it will become easier for consumers to compare products and services across different providers and have a better overview of their financial position.

Competitive Pricing & Better Customer Experience

With consumers getting more transparency on what the market has to offer, competition between financial institutions to offer better pricing and customer experience will be more intense. Institutions will likely be offering more personalised services at lower costs to ensure they stay competitive. This ultimately transforms the consumer-bank relationship with the rise in consumer power.

Implementation of open API

There are a total of 4 phases; Product information, Customer Acquisition, Account Information and Transactions. The phases will be rolled out throughout 2019, so be sure to keep yourself updated!

Open API has already become a compulsory regime in the EU and UK and contributed to innovation in their financial sector. Seeing the benefits, countries including Australia, the United States and Singapore are set to follow. Although a small step, Open bank API is crucial in transforming the way Hong Kong consumers and institutions interact and we are looking forward to seeing the positive changes it will bring.