“Another 5% from my salary!”

The Mandatory Provident Fund (MPF) has often been criticised and misunderstood by the Hong Kong public. This stems mainly from the hype around poor fund performances and the deliberate 5% mandatory deduction from employees’ salaries as part of the scheme.

However, contrary to popular belief, MPF forms a valuable part of your assets and plays an important part in determining your personal net worth in the future.

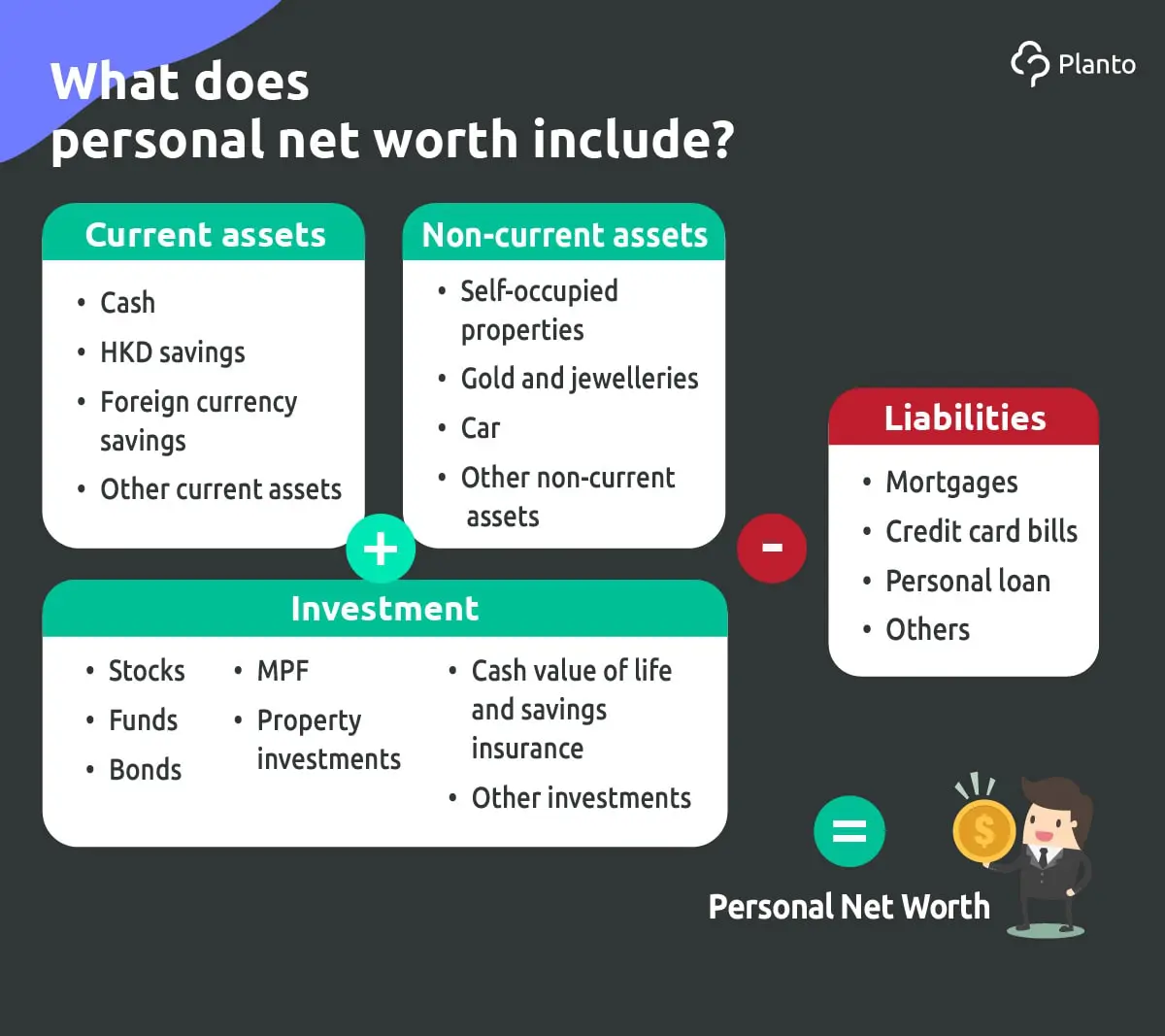

What is personal net worth?

Personal net worth refers to all your assets minus your liabilities. Knowing your personal net worth is an important step of financial planning.

Your MPF can be worth millions and play a significant part of your net worth –

According to the statistics of MPFA in 2018, there are around 2.8 millions of employees in Hong Kong who participated in the MPF scheme, making a total of 9.7 million MPF accounts and $813 billions of total assets. To most employees, their MPF accrued benefits can reach millions when they retire, making it a critical asset not to be ignored.

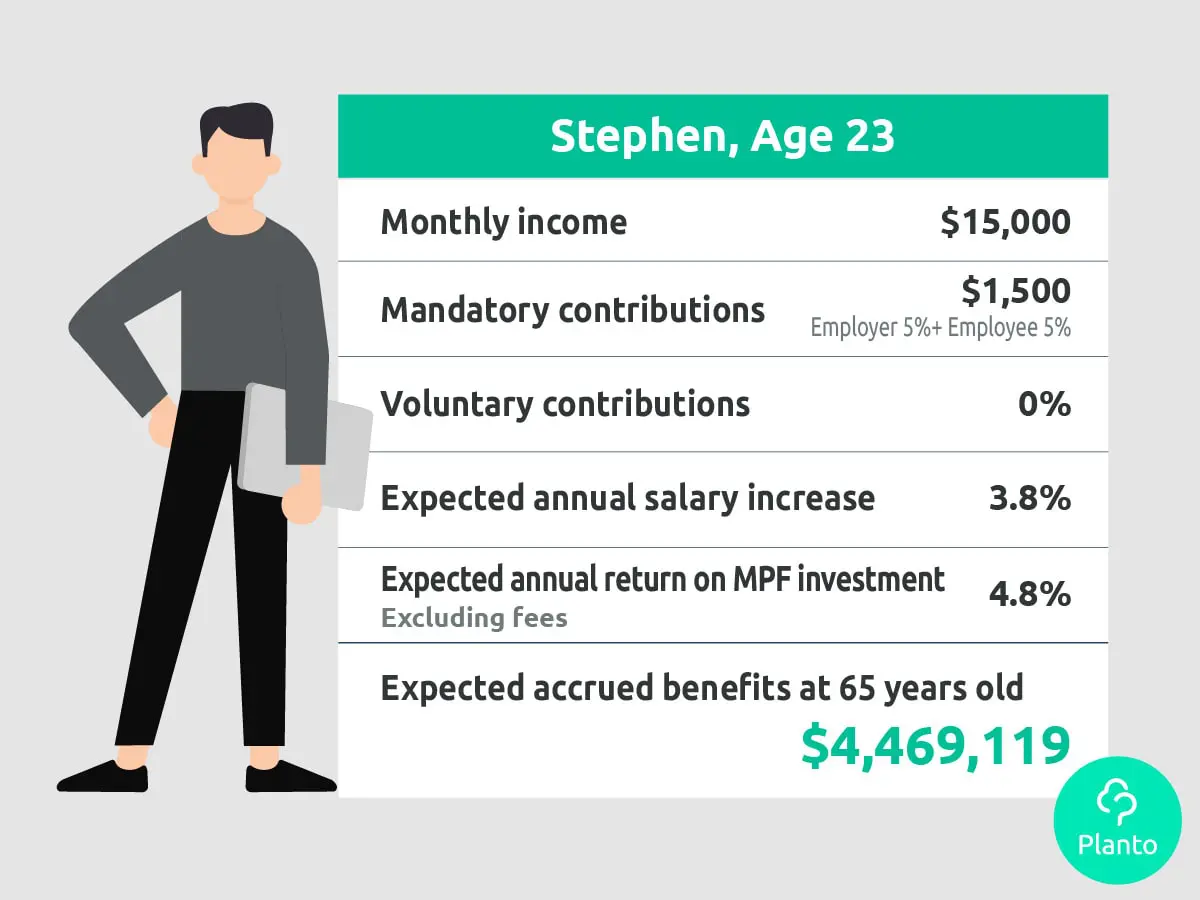

As an example, we have 23 year old Stephen, a typical recent Hong Kong graduate who earns $15,000 per month. With the mandatory contributions made by his employer and himself at 5% of income each, his expected MPF accrued benefits will be $4,469,119 by the time he is 65 years old!

Start taking your MPF more seriously now

It is important to be clear that MPF is not a monthly expense, nor a far-fetched retirement plan. It is an investment vehicle in your hands. If you manage it wisely, it will turn into a valuable asset for your retirement.

Try out our MPF calculator to project your MPF accrued benefits in the upcoming years:

It is also important to note that additional voluntary contributions (even as small as 1% of your monthly salary) can have a significant impact on your long term personal net worth. Check out how by clicking on the below!

(The numbers in the above case uses the same assumptions in the Planto MPF calculator. All currency is in HKD.)

Learn more:

[MPF 101] Voluntary contributions (VC) – What happens if you contributed more to your MPF? [MPF 101] Voluntary Contributions? – A breakdown of the three types [MPF 101] Tax Deductible Voluntary Contributions – FAQ

About Fidelity International

Fidelity International provides world class investment solutions and retirement expertise to institutions, individuals and their advisers – to help our clients build better futures for themselves and generations to come. As a private company we think generationally and invest for the long term. Helping clients to save for retirement and other long term investing objectives has been at the core of our business for 50 years.

FIL Investment Management (Hong Kong) Limited was established in Hong Kong in 1981 and is a subsidiary of Fidelity International. We have been managing retirement assets in Hong Kong since 1989. Fidelity is one of the largest MPF scheme providers in Hong Kong, offering members not only comprehensive product offerings but also competitive fees and professional services. With our outstanding investment capabilities and management quality, Fidelity MPF has captured a number of MPF industry awards over the years.

Today, Fidelity is the largest manager¹ in the ORSO employee choice market and the largest pure investment manager² to offer an MPF scheme.

Source:

¹ Willis Towers Watson “Manager Watch”, as at 31/12/2018.

² Mercer MPF Market Shares Report, as at 31/12/2018.

Important information

Investment involves risks. This material contains general information only. It is not an invitation to subscribe for shares in a fund nor is it to be construed as an offer to buy or sell any financial instruments. The information contained in this material is only accurate on the date such information is published on this material. Opinions or forecasts contained herein are subject to change without prior notice. Reference to specific securities mentioned within this material (if any) is for illustrative purpose only and should not be construed as a recommendation to the investor to buy or sell the same. Any person considering an investment should seek independent advice. FIL Limited and its subsidiaries are commonly referred to as Fidelity or Fidelity International. Fidelity, Fidelity International, and the Fidelity International logo and F symbol are trademarks of FIL Limited. This material is issued by FIL Investment Management (Hong Kong) Limited and Planto, and has not been reviewed by the Securities and Futures Commission.

This information is intended to be educational and is not tailored to the investment needs of any specific investor. This information does not constitute investment advice and should not be used as the basis for any investment decision nor should it be treated as a recommendation for any investment or action.

The results of the projection of MPF accrued benefits is calculated based on certain assumptions and it is for reference only.

Investment involves risks. Past performance is no guarantee of future results. The value of investments and the income from them can go down as well as up, so you may not get back what you invest. Stock markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments.

The third party mark appearing in this material is the property of the respective owner and not by Fidelity.

This material may contain materials from third parties which are supplied by companies that are not affiliated with any Fidelity entity (“Third Party Content”). Fidelity has not been involved in the preparation, adoption or editing of such third party materials and does not explicitly or implicitly endorse or approve such content. Any opinions or recommendations expressed on third party materials are solely those of the independent providers, not of Fidelity. Third Party Content is provided for informational purposes only.