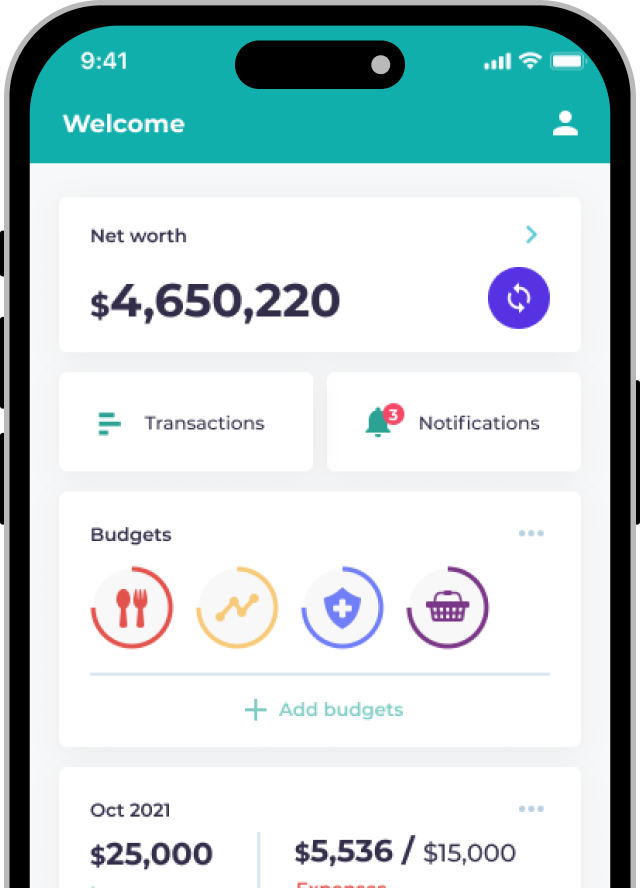

Since Hong Kong remains one of the world’s most expensive housing markets, you need to apply for mortgage if you wish to buy a property. The HKMA has set certain regulations on bank mortgage loans which affects the amount of mortgage first-time home-buyers can borrow and hence the size of the flat they can afford to buy.

This article will help you understand how Loan-To-Value Ratio (LTV) and Stress Test work so you can plan your first home!

LTV caps vary by property value: Up to 90% LTV for property value below $8 million.

In the past few years, the market has generally defined residential properties valued $6 million or below as “first-time homes”. However, first-time home-buyers in Hong Kong can now set their sights on more expensive flats under a new measure to relax mortgage rules announced in the 2019 policy address.

Under the new measure, the LTV caps, down payments, monthly repayment amounts and income requirements are calculated as follows:

| Property Value | LTV Cap | Down Payment | Loan Amount | Monthly Repayment Amount | Base Income Requirement | Stressed Income Requirement |

|---|---|---|---|---|---|---|

| $4,000,000 | 90% | $400,000 | $3,600,000 | $14,459 | $28,918 | $34,540 |

| $5,000,000 | 90% | $500,000 | $4,500,000 | $18,074 | $36,148 | $43,175 |

| $6,000,000 | 90% | $600,000 | $5,400,000 | $21,689 | $43,378 | $51,808 |

| $7,000,000 | 90% | $700,000 | $6,300,000 | $25,304 | $50,608 | $60,443 |

| $8,000,000 | 90% | $800,000 | $7,200,000 | $28,919 | $57,838 | $69,078 |

| $9,000,000 | 80% | $1,800,000 | $7,200,000 | $28,919 | $57,838 | $69,078 |

| $10,000,000 | 80% | $2,000,000 | $8,000,000 | $32,132 | $64,264 | $76,755 |

| $11,000,000 | 50% | $5,500,000 | $5,500,000 | $22,091 | $44,182 | $52,768 |

| $12,000,000 | 50% | $6,000,000 | $6,000,000 | $24,099 | $48,198 | $57,565 |

| $13,000,000 | 50% | $6,500,000 | $6,500,000 | $26,107 | $52,214 | $62,363 |

*The above table assumes a mortgage interest rate of 2.625%, a repayment period of 30 years, the mortgagor is not holding any residential properties in Hong Kong. The table does not include any additional insurance premium.

*The new LTV measure only applies to completed residential properties, in other words, off-plan properties are not applicable.

*If you fail the stress test, you will still be eligible for loans up to 80% or 90%, but the insurance premium will be adjusted accordingly.

*The new LTV measure does not apply to mortgage refinancing

*All leased properties have LTV caps of 50%, regardless of property prices

Mortgage Insurance Plans (MIP)

Mortgage insurance is a must if your LTV is more than 60%. It aims to protect mortgage loan providers (banks) from losses. The premium amount will range from about 1.15% to 4.35% of the loan amount.

For home-buyers taking mortgage loans with property values going beyond the existing caps, an additional 15% premium will be charged. Under the new measure, if you cannot pass the stress test, you will still be eligible for MIP loans up to 80% or 90% LTV ratio, subject to an additional adjustment to the premium based on relevant risk factors.

Home-buyers can choose between a single premium payment or an instalment payment. Besides, mortgagors often receive a premium discount from mortgage insurance providers.

Stress Test: less important under the new measure

When approving a mortgage loan application, banks will assess an applicants’ Debt-Servicing Ratio (DSR) to measure how stressful the mortgage’s repayments will be on an applicant’s finances. They will also perform a stress test to estimate their repayment ability after a simulated 3% raise in interest rate.

Before the Stress Test, the base DSR limit is 50%. For example, if you want to buy an $8 million property, with a loan amount of $7.2 million, an interest rate of 2.625% and monthly repayment amount of $28,919, your monthly income must be no less than $57,838 to get an approval for a mortgage loan.

The stress test is calculated at the current interest rate plus 3%, requiring the applicant’s DSR to be less than 60%. Using the above example, assuming the interest rate rises to 5.625%, the monthly repayment amount will increase to $41,447. The applicant’s monthly income must be no less than $69,078 to pass the Stress Test.

In the past, mortgage applicants are required to pass the Stress Test. But as mentioned above, under the new measure applicants will still be eligible for MIP loans up to 80% or 90% LTV ratio even if they cannot pass the Stress Test. This has greatly reduced the importance of the Stress Test.

| Property Value | LTV Cap | Loan Amount | Interest Rate | Monthly Repayment Amount | Base DSR Limit (50%) | Stressed DSR Limit (60%) |

|---|---|---|---|---|---|---|

| $8,000,000 | 90% ($800,000) | $7,200,000 | 2.625% | $28,919 | Min. income of $57,838 | Min. income of $69,078 |

*For the actual mortgage terms, please refer to the information provided by banks and insurance providers.

Mortgage Tips: Shop around to find the best interest rate and rebates

The mortgage rates currently offered by banks range from 2.375% to 2.625%. Many banks offer cash rebates as well, generally 1% to 2% of the loan amount. For a loan amount of $4 million, a cashback at 2% could be as high as $80,000. It could really help you repaying several instalments and reducing your mortgage burden.

Nevertheless, banks have different criteria for approving loans and rebates, which also depends on the applicant’s financial situation. Shop around and find the best mortgage offer for you!

Next steps