Futu Securities Fees & Features

Futu Securities, which was invested into by the Internet giant Tencent (0700.HK), is one of the most popular investment brokerages in Hong Kong with more than 600,000 users for its mobile app “Futu Niuniu”. The main advantages include cheaper transaction fees, a simple-to-use app, easy to trade Hong Kong stocks, US stocks and rich market research capabilities.

To help you more, we went through the account opening process and the user experience of buying and selling stocks and money market funds!

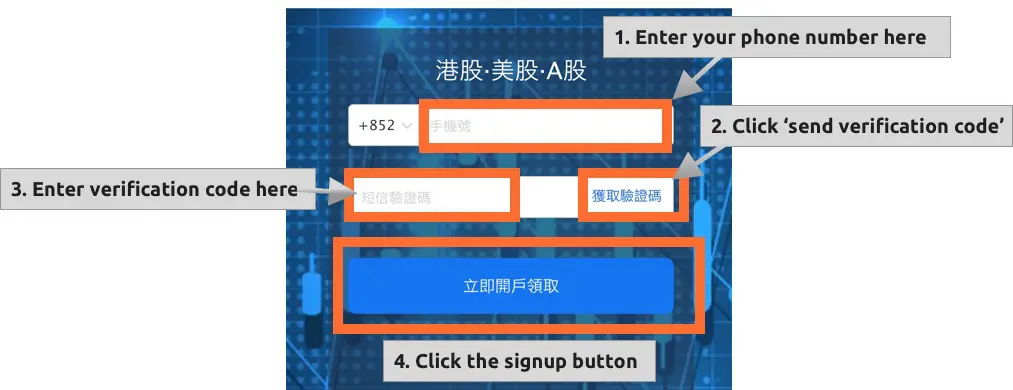

Futu Online Account Opening Process

The website is Chinese only but it’s easy enough to navigate

- Enter your phone number

- Click the ‘get verification code’ button

- Enter the verification code

- Click open account

Once you’ve done this, you can actually just switch to the Futu app and login with your phone number and continue the account opening process there. The steps include:

- Login to your account (via phone number)

- Prepare your HKID card and address proof (screenshots or pictures of the card or proof is fine!)

- Fill in some simple information such as name, date of birth, employment status, etc. Buying U.S. stocks involves U.S. taxation, so you must declare whether you are a U.S. citizen

- For identity verification, you can choose from three methods: online account opening, in-person appointment, or by submitting a cheque

and that’s it! The Planto team tested two account opening methods – doing it completely online and by making an appointment. Either way works and you can have your account open and ready to invest within 1-2 days.

100% online account opening & identity verification

This is the easiest way to open a Futu account. Fill out the information online and select “Open an account online”, use your mobile phone or computer to upload your ID card and address proof photo, then bind your bank account and deposit HK $ 10,000 to the Futu account shown on the screen. The sooner you do this, the quicker you can start investing!

Make an appointment to verify your identity

After filling in the information online and choosing “Make an appointment”, you can choose to meet with Futu staff and present your identification documents on the spot. Users can choose the time and place for the meeting. The Planto team submitted an online application on November 6 and successfully made an appointment to verify their identity at the Hong Kong MTR Station two days later.

Although it is “offline” account opening, in practice, the Futu staff only uses an iPad to take pictures and upload documents for applicants, which is almost the same as online account opening. The main benefit of meeting and opening an account is that you can open an account without having to deposit the HK$ 10,000 immediately when you open an account.

Trading of Hong Kong stocks, US stocks, and new shares

Futu has iPhone, Android, Windows and Mac versions of the app, which can be used to invest in Hong Kong stocks, US stocks and A shares. The buying and selling procedures are similar to those of the bank’s system. Select the stock, number of shares you want to buy, and order instructions and then you just wait for the order to be executed!

(Fun fact: Futu’s trading system claims to complete Hong Kong stock trading orders in 0.0037 seconds – although this probably won’t matter for most investors)

If you invest in US stocks, you can deposit US dollars into your account or exchange it via the Futu app directly. If investing in A shares, you’ll need to have RMB in the Futu A-share account. In addition, you can also subscribe to IPO stocks in HK and US although this would not be advisable for beginner investors!

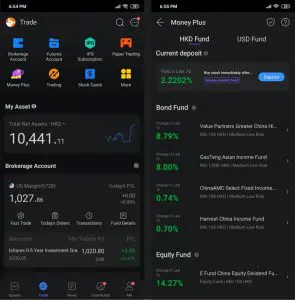

Futu MoneyPlus Fund

Futu MoneyPlus includes money market funds, stock funds and bond funds. The money market funds are particularly interesting: while you’re waiting to invest (whether it’s for research or waiting for the right time), you can put your idle funds in the money market funds and get an annualized return of nearly 2%, withdrawable at any time. Due to the low risk and stable returns of the money fund, you could almost consider it as a high-interest savings account.

Bond funds are low to medium risk, with greater volatility than money market funds, but also higher returns. As for equity funds, the potential risks and returns are both higher.

Stock quote, analysis, practical information

Another selling point of the Futu Niuniu app is that it can provide very rich market information, including real-time quotes, valuation trends, corporate financial analysis and forecast, financial news reports, stock market basics and other information about Hong Kong and US stocks. There’s also a community where you can discuss ideas with other fellow-minded investors!

Having said that, most of the research information is displayed in Simplified Chinese – if you can’t read Chinese, then it may not be that useful for you!

Luckily, this doesn’t impact the actual experience of buying and selling securities so if you’re looking for a low-cost broker, Futu can be a great choice (whether you speak Chinese or not)!.

Discover the Best Investment Account Fees and offers

Important information:

Investment involves risks. This information is intended to be educational and is not tailored to the investment needs of any specific investor. This information does not constitute investment advice and should not be used as the basis for any investment decision nor should it be treated as a recommendation for any investment or action. Past performance is no guarantee of future results. The value of investments and the income from them can go down as well as up, so you may not get back what you invest.