Since introducing the Faster Payment System (FPS) by the Hong Kong Monetary Authority, interbank transfers have become faster, easier, and free of charge. Besides transferring money to friends or merchants, the FPS can also be used for bill payments, topping up digital wallets, and locating card numbers.

Need help with how to use FPS? Want to understand more about its functions? Wondering what to do if you can’t receive money through FPS? Read this tutorial immediately for a comprehensive understanding of FPS.

Latest: Hong Kong’s FPS Soon to Connect with Thailand’s PromptPay

The Monetary Authority has announced that Faster Payment System (FPS) will be connected to Thailand’s similar real-time transfer service “PromptPay” on December 4, 2023. Once this connection is established, Hong Kong residents traveling in Thailand will be able to use the FPS feature of their Hong Kong bank accounts or e-wallets such as PayMe and Octopus to link with PromptPay. This will allow for quick payments by exchanging Hong Kong dollars for Thai Baht.

HSBC Bank will act as the agent bank for FPS cross-border payments to Thailand, determining the exchange rate from Hong Kong dollars to Thai Baht via FPS. The participating banks and e-wallets will determine the actual fees.

At the same time, Thai tourists can also make payments in Hong Kong using PromptPay. However, there are currently only about 50,000 merchants in Hong Kong that accept payments through FPS.

🇹🇭More about PromptPay

PromptPay is a very popular payment service in Thailand. It supports transactions using mobile numbers, Thai ID numbers, and QR codes, offering an experience similar to FPS. However, its acceptance among merchants far surpasses that of FPS. In Hong Kong, FPS is commonly used for P2P transactions but is less commonly used for shopping. In contrast, in Thailand, most merchants, be they large businesses or small market stalls, accept PromptPay payments.

As for the specific payment procedures, exchange rates, and fee details for connecting FPS with PromptPay, these are still to be announced. Drawing from the current user experience of PromptPay, it is anticipated that Hong Kong residents in Thailand will be able to make payments quickly by scanning a merchant’s QR code or using a mobile number, just like locals, which is expected to be easily adopted by Hong Kong tourists.

What is Faster Payment System (FPS)?

The Hong Kong Monetary Authority introduced the “Faster Payment System (FPS)” in 2018. The FPS is a real-time online transfer and payment system that connects Hong Kong banks, with features including:

- Operating 24/7, instant processing of transfers and payments

- Supports both Hong Kong dollars and Chinese yuan

- Transfer money between different banks and digital wallets

- Suitable for P2P transfers, transfers to merchants, payment of government bills, etc.

- Use eDDA to link to digital wallets, virtual bank accounts, securities accounts, and other services and quickly transfer funds between different accounts or set up automatic transfers.

How to Register for Faster Payment System (FPS)

Major banks in Hong Kong, such as HSBC, Standard Chartered, Bank of China, as well as livi bank and ZA Bank, all have Faster Payment System features; digital wallets like Octopus, AliPay HK, WeChat Pay HK, PayMe, etc., can also activate and link to FPS.

The methods to register for FPS in major banks and digital wallets are similar. You can register for the FPS service via your mobile phone number, email address, Hong Kong ID, or Faster Payment System Identifier (FPS ID). Registering with a mobile phone number will receive a confirmation SMS; if you register using other methods, you will receive an email notification.

FPS Default Receiving Account

When registering for the FPS, you can designate one of your accounts as the default receiving account for your mobile phone number, email address, or identity card number.

For example, if you register the FPS service with HSBC and Bank of China using your mobile phone number but set HSBC as your default receipt account, then whenever anyone makes a transfer using your mobile phone number through the FPS, if they do not specify a receiving bank, the funds will be deposited into your HSBC account.

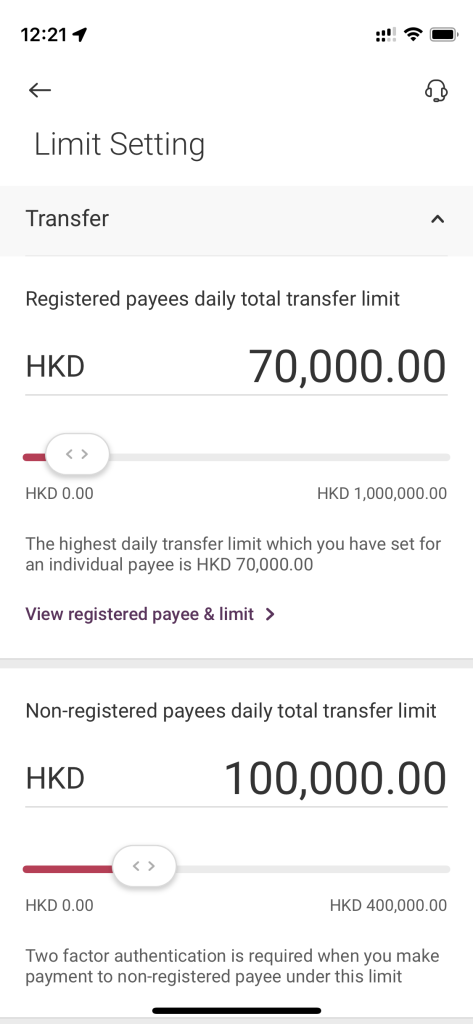

Setting Transfer Limits for FPS

FPS allows users to set limits restricting the maximum amount a user can transfer to strike a balance between convenience and financial security. There are no uniform standards for FPS transfer limits among banks. Each bank allows customers to customize their transfer limits in different ways. These typically fall into the following categories:

- Daily Limit for Small Transfers: Small transfers is FPS’s most commonly used P2P transfer function. It refers to quick transfers that do not require additional identity verification. Most banks set the FPS small transfer limit at HK$10,000, but you can adjust this to a lower amount.

- Daily Limit for Registered Payees: You can set a higher daily transfer limit for frequently used payees. The bank sets the upper limit and generally can reach HK$1 million to HK$1.5 million.

- Daily Total Limit for Non-registered Payees: The daily transfer limit for non-registered payees is lower, usually from HK$200,000 to HK$500,000.

In addition, some banks allow customers to set transfer limits for merchant transactions and the total limit for each category of transfers. Most banks provide more detailed transfer limit setting functions on their online banking accounts, while mobile app transfer limit settings are more straightforward. Each bank or e-wallet has different methods for setting limits, so if you’re unsure about something, don’t forget to ask the bank customer service.

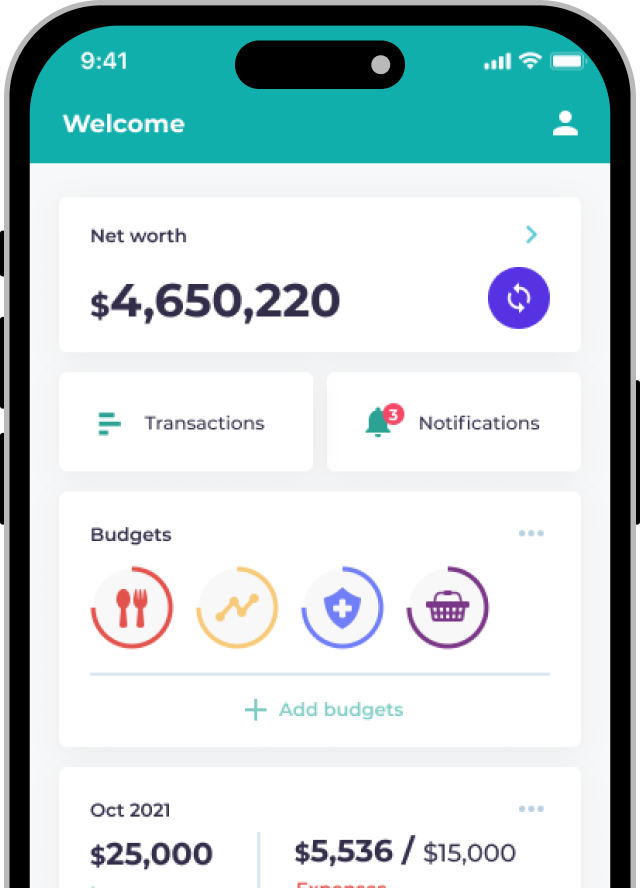

How to make a transfer with FPS?

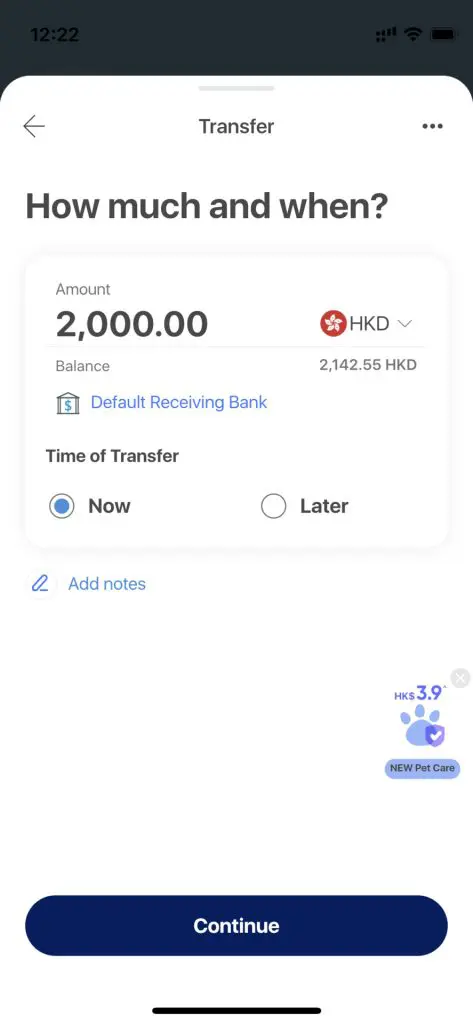

Using FPS to transfer funds is straightforward; most people should be able to do it quickly. Here are the main steps:

- Enter the payee’s information (mobile phone number/email/account number / FPS ID).

- Enter the transfer amount and currency. If needed, you can set the transfer time and frequency (for example, you can set up a monthly transfer to a specific account) and add note information.

- Verify the information and confirm to complete the transfer.

How to Use FPS QR Code for Payments or Receiving Money?

FPS has a QR code feature for payments and receipts, which can be used for P2P transfers and bill payments. Here are the steps:

- Generate an FPS QR code from a mobile app that supports the FPS QR code (or obtain the QR code from a bill).

- The payer scans the QR code.

- The payer enters the payment amount and details and completes the payment.

How to use FPS for Paying Credit Card Balance?

FPS can be used for bill payments and credit card balance payments. It can be used in ICBC Asia, Hang Seng, ZA Bank, livi bank, etc. You only need to register your credit card bill on the payment page, and you can make interbank credit card balance repayments.

However, please note that the issuing bank may need to wait one or two days to confirm the receipt of payment, so making interbank credit card repayments earlier is recommended.

Using FPS to Register for Direct Debit (Automatic Transfer)

FPS has an “Electronic Direct Debit Authorization” (eDDA) feature that lets your specified service provider debit your bank account directly.

You can use eDDA to link your e-wallet (such as Octopus and PayMe), virtual bank (such as livi bank), and or securities accounts (such as Futu Securities) to your traditional bank account under your name. Then, you can directly withdraw funds from the bank account on the mobile app of the above services.

Another everyday use of eDDA is to set up automatic transfers to pay public utilities, tuition fees, and other bills. The main difference from traditional automatic transfer services is that customers can complete the application entirely on online banking or mobile apps without filling out forms and queueing at the bank counter.

FAQ About FPS

There is no uniform limit for FPS. For most banks, the small transfer limit is HK$10,000; the limit for unregistered payees generally does not exceed HK$500,000; the transfer limit for registered payees varies from HK$1 million to HK$1.5 million, and customers can set their transfer limits for different payee categories.

Under normal circumstances, FPS can realize immediate transfers and the payee will usually receive the transfer notification within a few seconds. If the other party claims they can’t receive the money, you should first check whether the payee information you entered is incorrect.

In addition, as one phone number or email can be linked to multiple FPS accounts, the payee should also check whether the funds have been deposited into other accounts under their name. If the problem persists after verifying the information, you should immediately contact the bank for assistance.

Personal bank account customers generally won’t be charged for using FPS; business bank accounts might incur charges.

PayPal currently does not support the FPS.

The Hong Kong Jockey Club’s online betting account supports immediate transfers via FPS; once successfully registered, you can instantly deposit and transfer between the specified bank account and the betting account.