When it comes to investing, most people have heard the saying, “Don’t put all your eggs in one basket.” To effectively diversify your investments, it’s essential to have a good understanding of different markets, industries, and high-growth potential assets. However, the investment landscape is evolving every day, making it challenging for an average investor to dedicate enough time and energy to staying updated with complex financial news and data.

Endowus, Asia’s first and largest independent online wealth management platform established in Singapore, has recently introduced its “Flagship Portfolios” in Hong Kong. This service, offered as discretionary portfolio management service (“DPM”) provides retail investors access to investment strategies previously only accessible to institutions and high-net-worth individuals (those with assets of HK$8 million or more).

The Flagship Portfolios are currently the most popular investment options at Endowus in Singapore. They have gained investor trust with their high-quality institutional-grade funds, global diversification strategies, low fees, and excellent investment performance, boasting historical 5Y annualized returns of over 10%.

Discover how the Endowus Flagship Portfolios can be your gateway to steady wealth growth through intelligent investment strategies.

Withstand Market Challenges With Diversified Investment Strategy

As Nobel Prize laureate Harry Markowitz famously said, “Diversification is the only free lunch” in investing. Diversification involves spreading investments across different asset classes, industries, and geographies to reduce risk and achieve stable long-term returns. This balanced risk approach helps maintain a steady portfolio growth, which is crucial for long-term wealth accumulation and retirement planning.

Diversifying your investments helps reduce the impact of poor performance in one security or asset class on your entire portfolio. For instance, when the economy struggles, stock prices might decrease but bonds tend to perform better. Adapting the balance of stocks and bonds according to your risk tolerance can assist in mitigating the overall volatility of your portfolio.

Research by Vanguard indicates that investors must make correct decisions at least 75% of the time to achieve slightly higher returns than the traditional 60/40 asset allocation. This demonstrates that diversification is a more practical and proven strategy for most people and is more capable of withstanding market challenges.

Common Diversification Strategies

- Diversifying Asset Classes: Invest in different assets such as stocks, bonds, real estate, commodities, and private equity. This reduces the risk to the portfolio across various economic cycles and increases the potential for returns.

- Diversifying Industry Risks: Spread investments across multiple industries like technology, healthcare, finance, and consumer goods. This minimizes the risk associated with downturns in any single sector.

- Diversifying Geographic and Geopolitical Risks: Invest in different regions or countries to mitigate political or economic risks. This helps avoid the impacts of trade wars, sanctions, political instability, or regional conflicts on investments.

Endowus Flagship Portfolios: Achieve Long-Term Growth Through Diversification

The Endowus Flagship Portfolios utilize strategic global passive asset allocation and top-tier institutional strategies to demonstrate the full power of diversification. Investors can customize their equity-to-bond ratio based on risk tolerances and return expectations.

The “Very Aggressive” option (100% equities allocation) in the Endowus Flagship Portfolios spreads investments across high-quality funds managed by Dimensional Fund Advisors, iShares by BlackRock, and Amundi. These funds were previously only available to large institutional investors. Backtesting data shows that this asset allocation strategy produces an annualized return of over 10% over 5 years. Additionally, a 60/40 equity-to-bond allocation in the portfolio achieves a robust 7.5% annualized return.

| Top 10 Holdings of Endowus Flagship Portfolios (100% Equity) | Percentage |

| Microsoft Corp | 2.56% |

| Apple Inc | 2.47% |

| NVIDIA Corp | 1.89% |

| Amazon.com Inc | 1.38% |

| Meta Platforms Inc Class A | 1.02% |

| Alphabet Inc Class A | 0.81% |

| Taiwan Semiconductor Manufacturing Co Ltd | 0.77% |

| Alphabet Inc Class C | 0.70% |

| Broadcom Inc | 0.56% |

| Eli Lilly and Co | 0.56% |

| As of May 2024 | Portfolios | |||||

| Annualized Return | 100% Equity | 80% Equity-20% FI | 60% Equity-40% FI | 40% Equity-60% FI | 20% Equity-80% FI | 100%Fixed Income |

| YTD | 8.2 | 6.6 | 5.1 | 3.5 | 1.9 | 0.4 |

| 1 Year | 22.9 | 19.5 | 16.0 | 12.6 | 9.3 | 6.0 |

| 3 Tears | 4.9 | 3.8 | 2.5 | 1.4 | 0.1 | -1.2 |

| 5 Years | 11.6 | 9.6 | 7.5 | 5.4 | 3.3 | 1.1 |

The Power of Compound Interest

The table above shows that a diversified investment portfolio helps capture long-term asset growth opportunities. When making long-term investments, remember to leverage the power of compound interest.

Compound interest involves reinvesting investment returns to grow assets, similar to a snowball effect. With an average annual return rate of 10%, a one-time investment can increase tenfold in 25 years. For instance, investing HK$100,000 could grow to approximately HK$1,083,000 in 25 years. This demonstrates that disciplined diversification in high-growth potential quality assets, combined with the power of compounding, can significantly amplify wealth growth.

Why Choose Endowus to Build Your Diversified Investment Portfolio?

You may wonder why you should opt for Endowus Flagship Portfolios, given the numerous index funds employing diversification strategies available on the market and the fact that buying a single index fund already provides a certain level of diversification.

Let’s compare the performance of the Endowus Flagship Portfolios with that of the Hang Seng Index and the S&P 500 Index to see if an individual can outperform professional investment advisors by simply buying index funds.

| Investment Portfolio | 5-Year Annualized Return (As of May 2024) |

| Endowus Flagship Portfolios(100% Equity) | 11.6%*% |

| HSI | -3.87% |

| S&P 500 | 15.8% |

Endowus Flagship Portfolios vs. Hang Seng Index

The Hang Seng Index has been underperforming in recent years. However, many investors are hopeful that Hong Kong stocks will bounce back from their lows, looking to profit from a potential upswing. Conversely, those who are pessimistic about Hong Kong stocks may use tools such as inverse ETFs to profit from declines. From the perspective of portfolio management, Hong Kong investors who concentrate too much on profiting from the fluctuations of the Hang Seng Index may have fallen into the “home bias” trap.

“Home bias” is an ordinary investor mindset in which investors prefer their local market, which they are more familiar with, over foreign markets they know less about. This preference for local investments overlooks the benefits of having a more diversified international investment portfolio.

Many Hong Kong investors tend to focus too much on the Hong Kong market and may overlook global investment opportunities. Due to the poor performance of Hong Kong stocks in recent years, investors with a strong preference for local investments may have suffered considerable losses.

Compared to investing solely in the Hang Seng Index through the Tracker Fund or other index funds, investors using Endowus’s global diversification strategy can achieve more stable and potentially higher returns. This helps reduce the risks associated with investing in a single market.

| Top 10 Markets Invested by Endowus Flagship Portfolio (100% Equity) | Percentage |

| United States | 39.6% |

| Japan | 6.61% |

| China | 3.8% |

| Taiwan | 3.77% |

| South Korea | 2.5% |

| India | 2.48% |

| Australia | 2.06% |

| United Kingdom | 1.36% |

| Canada | 1.08% |

| Brazil | 0.99% |

Also, in the Hong Kong market, the median expense ratios for stock and bond funds are 1.85% and 1.35%, respectively. On the other hand, the Endowus Flagship Portfolios have an expense ratio of only 0.21% to 0.35% per year. This means that investors can retain at least 1% of their returns annually, providing a cost-effective way to diversify investments.

For instance, if you invest HK$100,000 in a fund with a presumed annual return of 7%, a 1% variance in fees (1.75% vs. 0.75%) over thirty years could lead to a difference of up to 152% of your initial investment!

Endowus Flagship Portfolios vs. S&P 500 Index

Over 5 years, the annualized return of the S&P 500 Index seems slightly higher than the Endowus Flagship Portfolio’s all-equity allocation. But does this mean that investing directly in the S&P 500 Index is better?

Another common investment bias is “recency aversion”, which means focusing too much on recent events, ignoring long-term trends and data, and forgets historical lessons.

In the past decade, U.S. stocks have generally performed well, but there have been periods of decline. For example, after the dot-com bubble burst in 2000, there was a problematic “lost decade” for U.S. stocks. Market data indicates that from 1999 to 2009, the S&P 500 Index had an annual return of -1% and the Nasdaq Index had an annualized return of -5%. Investors who bought into the Nasdaq index fund at its peak in March 2000 had to wait 14 years to break even.

Thus, although the S&P 500 has recently performed well, it is crucial to remember the importance of diversification and long-term planning to mitigate the risks associated with market volatility.

Diversification remains the simplest and most effective strategy for avoiding the pitfalls of buying at market peaks. The Endowus Flagship Portfolios bring together top global funds and tailor investment portfolios based on investors’ risk preferences. By combining quality management with a diversified investment strategy, Endowus allocates funds across multiple regions and funds, achieving global asset allocation rather than chasing the hottest assets of recent years.

It’s also worth noting that Hong Kong investors face a 30% dividend tax when buying US ETFs. On the other hand, Endowus builds its portfolios using UCITS funds, which can help Hong Kong investors save on these taxes, depending on their tax residency.

Giving Retail Investors Access to Top Institutional-grade Funds

Through the Endowus Flagship Portfolios, retail investors can benefit from institutional-level strategies managed by top global fund managers such as Dimensional Fund Advisors, Amundi, iShares by BlackRock, and PIMCO. So you can enjoy the following benefits:

- Dimensional Fund Advisors: DFA applies academic research to practical investment, managing over US$700 billion in assets. It formulates investment strategies based on market efficiency and financial science to identify assets with high return potential.

- BlackRock: BlackRock is the largest asset management company globally, providing a wide range of investment products, including U.S. and global stocks, bonds, commodities, and real estate.

- Amundi: Europe’s largest asset management company, managing over €2 trillion in assets, is renowned for its commitment to sustainable investing.

- PIMCO: The world’s largest active bond management company, excelling in bonds and debt securities, providing investors with tactical investment opportunities.

Also, the Endowus Flagship Portfolios provide discretionary investment management. Endowus’s professional investment team makes buy and sell decisions on behalf of clients. This means clients don’t need to constantly monitor the market or manage trades, which is especially convenient for Hong Kong investors dealing with significant time differences when investing in the U.S. and other overseas markets.

Comprehensive Investment Options with Transparent Fees

The Endowus Flagship Portfolios offer six asset allocation options: all-equity allocation (Very Aggressive), 80/20 equity-bond allocation (Aggressive), 60/40 equity-bond allocation (Balanced), 40/60 equity-bond allocation (Measured), 20/80 equity-bond allocation (Conservative), and all-bond allocation (Very Conservative).

Whether you are a conservative or aggressive investor, you can find asset allocation options that match your risk tolerance and investment goals. When choosing an asset allocation, you can consider key information such as annualized returns, underlying assets, investment regions, and industries. This will help you easily grasp how Endowus implements diversification for you.

Endowus does not charge subscription, redemption, switching, or transaction fees. The only fee for the Flagship Portfolios is an advisory fee based on the assets held, ranging from 0.25% to 0.60% per annum. Additionally, Endowus rebates 100% of all fund sales commissions to clients, saving them on investment costs and ensuring they receive unbiased and reliable advice.

Invest with the Endowus Flagship Portfolios Now

- Outstanding Performance: The Endowus Flagship Portfolios have shown impressive performance over the years, with the 100% stock portfolio achieving an annualized return of 11.6%* over the past 5 years.

- Access to Global Institutional-grade Funds: Through the Endowus Flagship Portfolios, you can invest in products previously only available to institutional investors and high-net-worth individuals.

- Diversification Strategy: The Flagship Portfolios emphasize diversification to achieve stable long-term returns.

- Professional Management: Managed by a professional investment team that does not charge sales commissions, offers independent advisory services with no conflicts of interest and always prioritizes clients’ best interests.

- Clear and Low Fees: The Flagship Portfolios have no subscription fees, redemption fees, switching fees, transaction fees, or hidden charges. The only fee is an advisory fee ranging from 0.25% to 0.60%, making the costs simple and transparent.

*Source: Morningstar and Endowus Research. Based on monthly data as of May 31, 2024. The performance numbers represent the hypothetical back-tested portfolio results using historical performance based on the net of fee returns of the suggested share classes and the oldest USD share class for the funds where required to get a 5-year track record.

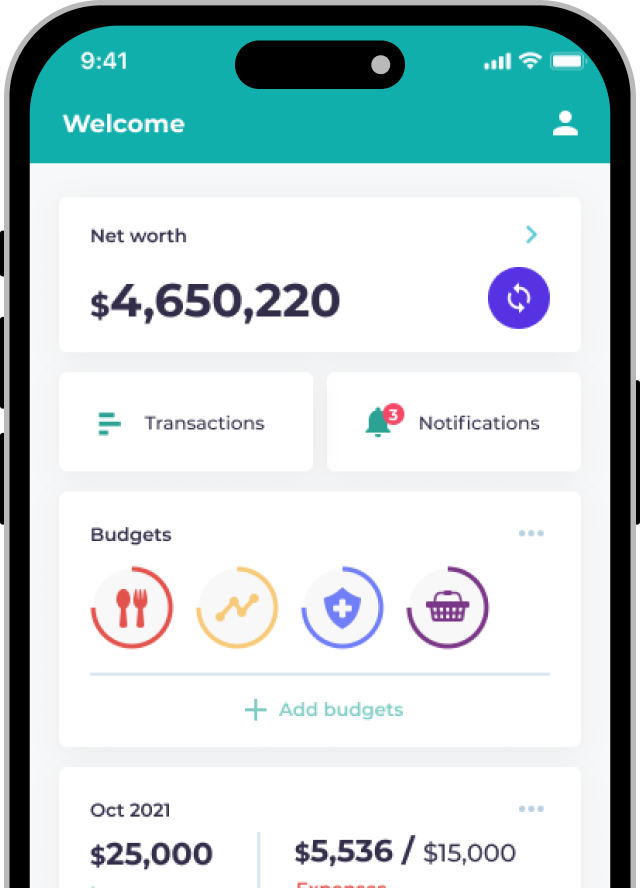

Open an Endowus Account Online in Just 10 Minutes

Endowus offers a seamless online account opening service, allowing Hong Kong users to complete the process through the website or mobile app.

- Sign up on the Endowus website or mobile app with your email, set a password, and complete phone number verification.

- Fill in your personal details and complete the financial risk assessment.

- Upload your ID card or passport.

- As the Hong Kong Securities and Futures Commission requires, deposit HK$10,000 or more via bank account to complete the account opening process.

- Approval can take as little as one working day, and you will be notified via email once your application is successful.

Note: Endowus Flagship Portfolios are offered as Discretionary Portfolio Management (DPM) services, providing institutional-grade portfolio construction, ongoing monitoring, updates and changes by the Endowus Investment Office. Clients will have to agree to a DPM service agreement before investing into the portfolios.

FAQ About Endowus

Endowus, headquartered in Singapore, was established in 2017 and licensed by the Monetary Authority of Singapore and the Hong Kong Securities and Futures Commission. It is Asia’s largest independent online wealth management platform, currently managing over HK$46 billion (US$6 billion) in assets. Endowus is the only online wealth management platform authorized to provide services for Singapore’s Central Provident Fund (CPF). Its shareholders include UBS, Citi Ventures, MUFG Bank, EDBI (Singapore Economic Development Board’s investment arm), and Samsung Ventures.

In compliance with the Hong Kong Securities and Futures Commission regulations, client funds and assets are kept separate from Endowus’s company assets. All investments are held in custodial accounts maintained by transfer agents of respective fund companies (such as Fidelity, Invesco, etc.). Uninvested cash balances are held in a segregated client money account at HSBC Hong Kong, regulated by the Hong Kong Monetary Authority.