There are a lot of credit cards in the market and each of them have their own unique benefits and welcome offers. You could get cards that focus on: cash-back, air miles, Automatic Octopus Topups (AAVS),better exchange rates or discounts when spending overseas, or just access to airport lounges!

Unfortunately there's no single "best" card out there – it's all about what suits you most. To help you make the best financial decision – the Planto team has curated, simplified and compared the top credit cards in the market.

The above table shows that each credit card has its pros and cons, and there is no perfect card out there because everyone's spending habits and saving needs are different. When choosing a credit card, it may help to ask yourself these questions:

- Do I value air miles or cash rebates?

- Do I have a lot of foreign expenses, including expenses from shopping abroad or online shopping from foreign websites?

- Where do I spend most of my money – is it food and beverage, entertainment, online shopping, tuition fees, water and electricity charges, etc.?

- Will I ever use airport lounge services?

- Do I often use Octopus to automatically add value?

Frequently Asked Questions

How does the credit card application process work?

To apply for a credit card, you must be at least 18 years old and meet the minimum income requirement for the card. When applying, you'll often need to submit proof of income, proof of address and a copy of your ID. Applying for a credit card online is the quickest and usually only takes 10-15 minutes. The approval time depends on depends on the bank and the applicant's financial situation – ranging from days to weeks. If your credit score is not good, the bank may also refuse to approve the card or, in some cases, may give you a lower credit limit.

Can I apply for many cards at the same time?

Each time you apply for a credit card, the bank will check your credit history – this is also known as a 'hard inquiry'. If someone's credit history has been inquired multiple times in a short period of time, the bank may worry about the applicant's financial situation because it implies the person is in need of credit e.g. a loan and is trying to apply to anyone who will give it to him. This can affect your credit history which may result in higher interest rates when applying for a loan or mortgage!

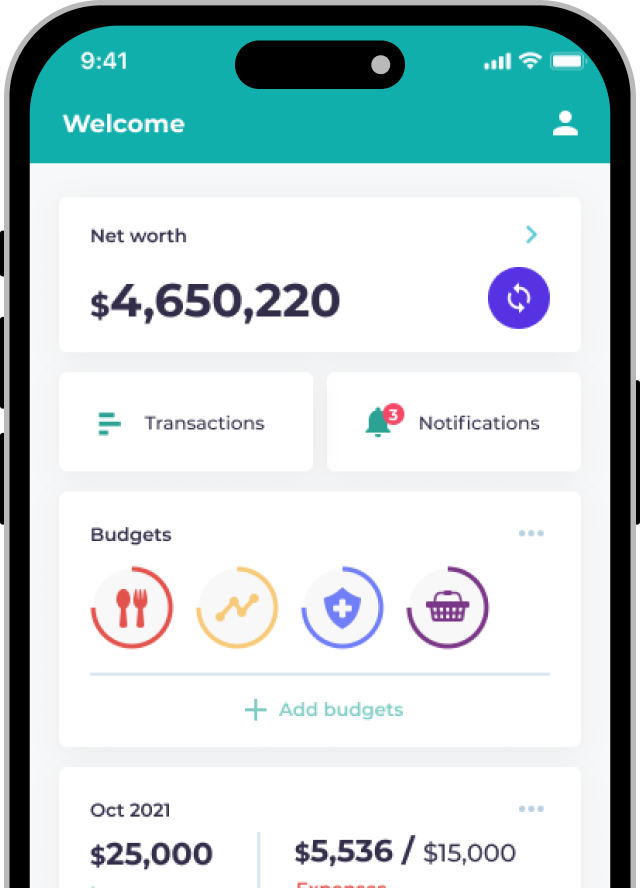

Another problem you may face is keeping track of your repayments for the credit cards and figuring out where you're spending! Luckily, the Planto app has a payment reminder feature to ensure you will pay your credit card before the due date.

Can the credit card annual fee be waived?

Many credit cards have no annual fee in a promotional period (often lasting 1-2 years) which means you may not need to pay an annual fee in the beginning anyway! Aside from that, one of the 'unspoken rules' of credit cards is that as a customer you can actually call the bank and request an annual fee waiver! If you've already been charged, you can still try to request them to waive and refund it to you! The Planto app will notify you of any fees you're charged including late payment and annual fees so you can take action towards it!

Do credit card rewards expire?

It depends! Most rewards last a year, but some banks offer reward points that never expire. If points expire and are not redeemed, they cannot be recovered. If you need some time to get enough reward points for a certain purchase, you could try to call the bank and ask them to give an extension – but it's not likely the bank will approve it. If you link your credit cards to Planto, you'll receive reminders and notifications before the points expire so you don't lose any money!

What happens if I only pay the 'minimum payment' each month?

You should always try to pay your statement balance on time! The actual interest rate of a credit card can exceed 30% so if you only pay the 'minimum payment', the fees will compound and over time may become more than the amount you had to pay! Furthermore, if you miss your payment, you may be charged a late fee and a handling fee which will make it cost even more. Planto reminds you if you're charged a late fee so you can pay your statement (in case you forgot) and request a waiver!

What happens if I lose my credit card?

Please contact the issuing bank (usually a 24-hour hotline) as soon as possible! They will be able to deactivate your card immediately and re-issue a new one (accompanied with a new credit card number). If the credit card has automatic transfer, Octopus automatic value-added, etc., you would have to set those up again with the relevant institution (unless your bank offers to help with it). Any payments that happen in case of theft will be refunded by the bank as long as you report the theft or loss when it happens.

How do I cancel my credit card?

If you want to cancel your credit card, you can call the issuing bank or go to the branch in person and follow their procedure.

With these questions our table above as a guide, you can get closer to finding the right credit cards for you.

In case you're asking yourself: "How can I pick the right card if I don't know how I spend my money?"

That's what Planto is here for! After linking your credit card and savings accounts to the app, Planto gives you insights on your spending patterns, your spending categories and top merchants, essentially giving you the information you need to pick the right credit card.

About Planto

Planto is a Hong Kong fin-tech start-up that brings the new generation a revolutionary intelligent personal finance application. We are generously supported by iDendron from The University of Hong Kong and Cyberport to help Hong Kong users to manage their finances and save money, starting their journeys towards life goals like purchasing a flat, getting married, travelling and studying.

Like Planto Facebook page and follow our Instagram now to receive useful tips on personal finances!