It’s important to ensure you’re not taking too much risk when you’re investing. You do it all the time in everyday life if you buy insurance, wearing a seatbelt in a car or even when going for a run. It’s not that you can avoid risk entirely but you want to give yourself the best chance of succeeding – whether it comes to your health or growing your investments.

The surest way to reduce risk when it comes to investing is to ensure your portfolio is diversified. There’s two main categories of risk:

- Systematic risk: This means macro-economic risks in the broader market, geographies or asset classes e.g. the recent China-US trade war, or the dot com bubble in the early-2000s

- Unsystematic risk: This means risks specific to your investments e.g. video games regulation in China affecting Tencent, or data security concerns over Facebook

What is diversification

In short, diversification is the concept of “don’t put all your eggs in one basket”. However, an even better way is thinking about it like a fruit market.

If you were running a fruit market, rather than selling only one kind of fruit, you’d want to sell many different kinds. If a natural disaster occurs which means mangoes are no longer available, you’d want to make sure you have other fruits to sell as well!

The natural disaster here is a systematic risk and the different fruits would be asset classes.

To go a step further, rather than buying all your mangoes from the same supplier, you’d want to have multiple suppliers in case one goes out of business, increases their price (among the many other reasons) – this would be an example of ‘unsystematic risk’.

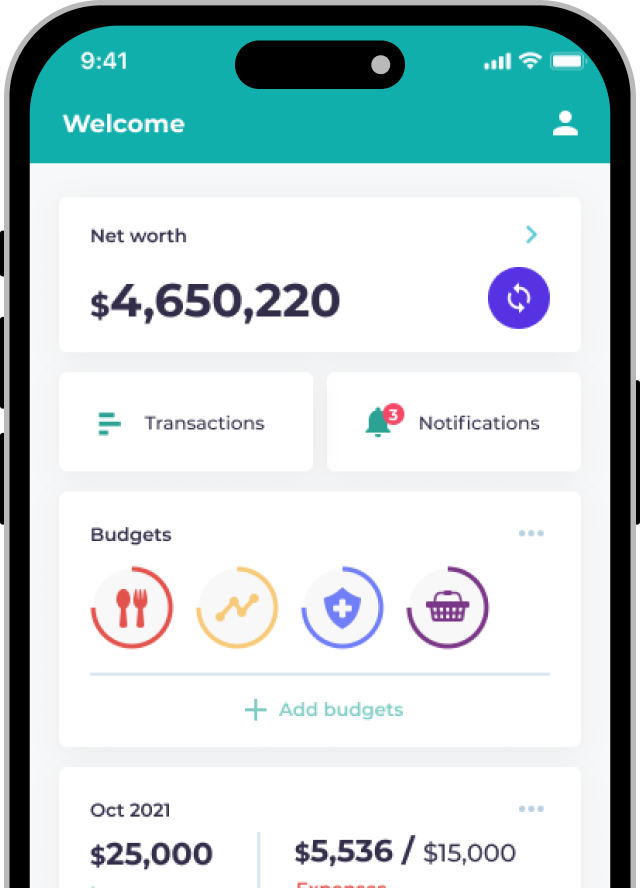

How do you use diversification in a portfolio

The first step for any investor is to diversify between asset classes: equities (e.g. stocks), fixed income (e.g. bonds, money market funds, etc.) and alternatives (e.g. art, commodities, etc.).

The next step would be, for each asset class, to invest in different geographies, and then choosing different company sizes and industries.

Lastly, you would diversify away from ‘single’ companies by buying mutual funds, ETFs or a large number of individual securities.

Different asset classes, company sizes and sectors have their own risks and their own returns so each investor needs to think about their own risk tolerance when creating their portfolio. A younger couple may want to invest with higher risk to get higher returns, while someone closer to retirement would want stable returns with low risk.

Why regular rebalancing matters

Once you have determined what your portfolio should look like, it’s important to make sure it remains the same over time. It can be very tempting to chase ‘high return’ stocks but if you think about past events e.g. dot com bubble or the 2008 financial crisis, investors who were primarily in tech or financial services stocks suffered huge losses compared to more diversified investors.

Over time, if you have determined your ideal portfolio is 80% stocks and 20% bonds portfolio, it’s quite likely according to historical data that your stocks would get higher returns and thus become a larger part of your portfolio e.g. 90% stocks and 10% bonds instead. At times likes this, you need to rebalance your portfolio back to match your original risk tolerance (80% stocks, 20% bonds).

Summary

Building a diversified portfolio can seem like a lot of work – and it is if you want to do it right! Signs of good diversification are that that your investments work well together (if your riskier investments go down, your less risky investments shouldn’t go down as much), and that your portfolio matches your risk tolerance and goals.

Next steps

Important information:

Investment involves risks. This information is intended to be educational and is not tailored to the investment needs of any specific investor. This information does not constitute investment advice and should not be used as the basis for any investment decision nor should it be treated as a recommendation for any investment or action. Past performance is no guarantee of future results. The value of investments and the income from them can go down as well as up, so you may not get back what you invest.