Aqumon is the first US ETF robo-advisor (automated investment consultant) in Hong Kong. You tell them about yourself and your risk appetite, and they build an investment portfolio and do everything (buying, selling) for you. The Planto team has deep-dived into Aqumon’s pricing and account opening process to help you decide if they’re right for you.

Background

Aqumon was incubated in HKUST and are fully licensed by the Securities and Futures Commission (SFC) for Type 1, 4 and 9. They’ve partnered with 60+ financial institutions including CMB Wing Lung Bank, ChinaAMC and BOCI so they have a strong track record as well.

How it works

The account opening process is end-to-end online and can be done either via mobile or on a computer. It can feel a bit longer than opening an account with a securities broker but, ultimately, it only took us about 10 minutes to open our account and then another day for the money to be transferred in.

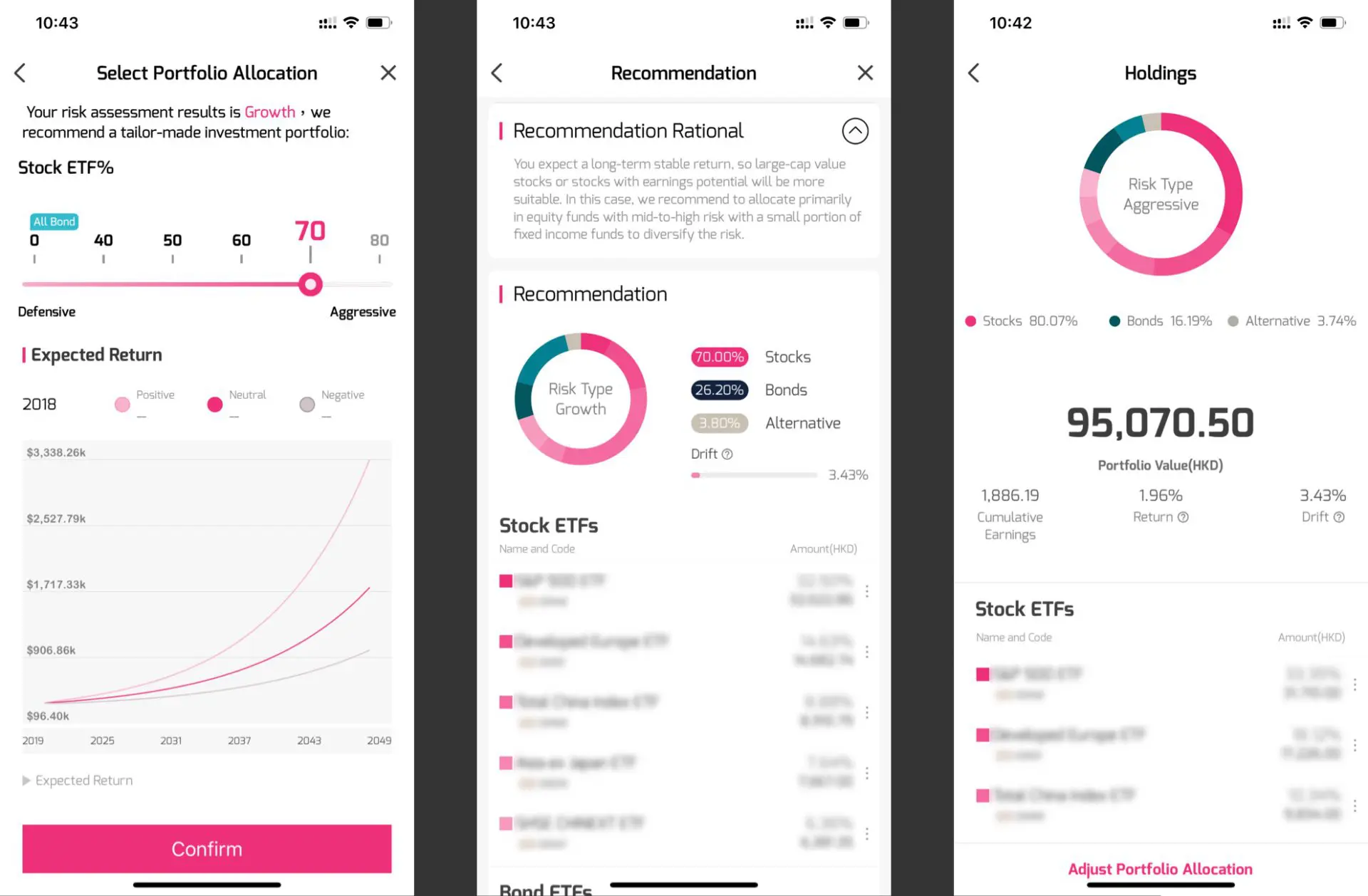

Once you’ve opened your account, you answer a few questions about your risk tolerance and Aqumon will start building your portfolio. All you need to do is tell them whether you would like your portfolio to have more stocks (higher risk, higher return) or bonds (lower risk, lower return) and a new portfolio is created just for you!

AQUMON Features and Highlights

- Algorithm Based on Nobel Prize-Winning Theory: Provides investment recommendations by integrating macroeconomic indicators, market data, and individual risk levels.

- Low Robo-Advisor Fees: Consultation fees can be as low as 0.5%.

- Fully Online Account Opening and Investment Process: Easy and convenient online setup and management.

- User-Friendly Interface: Designed for ease of use, even for beginners.

- Customized Investment Portfolios: Tailored to match users’ risk preferences.

- Global Market Access: Invests in over 50 markets worldwide, covering 20,000 types of stocks, bonds, and alternative assets.

- 24/7 Portfolio Monitoring: Provides real-time alerts for portfolio adjustments.

- Licensed and Secure: Holds SFC licenses 1, 4, and 9 (Central Number: BJU619), ensuring safety and reliability.

Who Should Use AQUMON?

AQUMON continuously innovates its product offerings, currently providing four types of products suitable for different investors:

- Long-Term Investors or Those Without Time to Monitor Markets: Flagship Hong Kong and U.S. stock ETF portfolios (five risk types from conservative to aggressive).

- Investors Who Struggle with Stock Picking: Thematic stock portfolios with an average annual return of 32.41% (suitable for growth and aggressive investors).

- Short-Term Investors: Includes stock trading and 24/7 currency exchange services.

- Conservative Investors Seeking Stability: Cash management portfolios that use idle funds to generate stable income.

In addition to catering to general individual investors, AQUMON offers customized investment solutions for the mass affluent, family offices, and wealth management institutions through AQUMON Bespoke. This service combines one-on-one professional investment management with leading investment technology to enhance the overall investment experience for clients.

Summary

In all, Aqumon is transparent about their performance, which (historically, at least) has been quite strong. With the new SmartStock Portfolios, they are great for people who are looking for high growth but want a completely hands-off process.

Discover the Best Investment Account Fees and offers

Important information:

Investment involves risks. This information is intended to be educational and is not tailored to the investment needs of any specific investor. This information does not constitute investment advice and should not be used as the basis for any investment decision nor should it be treated as a recommendation for any investment or action. Past performance is no guarantee of future results. The value of investments and the income from them can go down as well as up, so you may not get back what you invest.